APPLYING WEALTH MANAGEMENT STRATEGIES

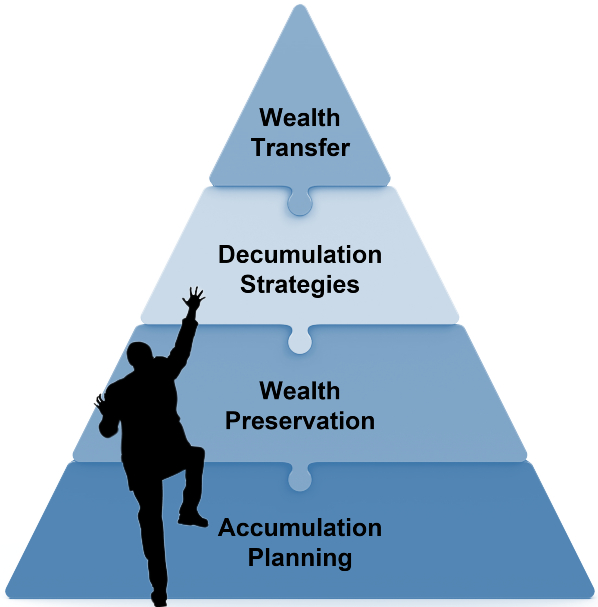

Wealth management is only a portion of our process. It forms one of the Seven Pillars of Financial Success that are cemented in a single financial planning foundation. These management strategies generally revolve around the four phases of the wealth life cycle, including:

- Accumulation and growth

- Wealth preservation

- Decumulation process

- Wealth transfer

ACCUMULATION AND GROWTH PHASE

With today’s volatile environment, clients are looking for strategies that can help them grow their assets. They also want retirement savings they can count on to help maintain the lifestyle they want in retirement. With concerns about market downturns, rising healthcare costs, and longer life expectancies, the desire for accumulation planning becomes clear.

Accumulation Planning

Accumulation planning is an aspect of wealth management that requires different expertise than typical investment planning and bond portfolio implementation. It begins with the simplest strategies that revolve around living within your means, embracing low-cost investing and long-term strategies, and avoiding mistakes like allowing emotions to guide decisions. It also encompasses more complex strategies pertaining to employer-related retirement plans and stock options, margin strategies, and real estate exchanges. Another strategy during this phase also applies the power of tax deferral.

Alternative Investments

These types of investments may also be an option for the right investor.* One of the premier features of alternative investments is diversification, which results from the inclusion of investments that react differently to the markets than more traditional investments. Examples of alternative investments include managed futures, hedge funds, tax shelters, and real estate. Though most investors understand that as risk increases, the potential for return can also increase, these products generally involve substantial risk and limited liquidity.

*Investing in alternative investments may not be suitable for all investors and involves special risks, such as risk associated with leveraging the investment, utilizing complex financial derivatives, adverse market forces, regulatory and tax code changes, and illiquidity. There is no assurance that the investment objective will be attained. Diversification does not assure a profit or protect against loss in declining markets, and diversification cannot guarantee that any objective or goal will be achieved.

WEALTH PRESERVATION PHASE

Generally, you can anticipate a third of your life to be left when you retire. This means that your preparations must be flexible enough to cover a large span of years. It can be tricky to come up with a plan that meets all of your retirement goals. By signing up for a free planning account, you can get the industry’s first integrated financial and tax planning app solution to help you identify, plan for, and track your goals. The app can help you:

- Optimize your tax reduction strategies

- View your asset allocation

- See options to view your probability of success

- Receive notifications regarding upcoming tasks

- And much more!

Your retirement years can span decades and with any financial planning, you’ll want to seek professional advice to help ensure you remain on track and that your money lasts as long as you need it.

Risk Management

Wealth management requires a deep understanding of your tolerance for risk and behavioral tendencies, especially during periods of market volatility. By quantifying that risk with a Risk Number, we help clients manage emotions, cognitive biases, and the natural tendency to take action during periods of volatility.

Risk management is a critical component of wealth management and its intent is to minimize financial and other potential losses associated with risks to your assets, health, or business. A good risk strategy will be well‑coordinated with your overall plans for business, investments, taxation, estate, and retirement.

Asset Allocation

Allocation is also a strategy used as part of a robust wealth management strategy. Asset allocation* aims to balance risk and reward by allocating your portfolio’s assets among a variety of investment categories and according to your goals, level of risk tolerance, and investment horizon. The process aims to:

- Reduce overall investment risk

- Create more reliable investment forecasts

- Improve the risk and return tradeoff of your portfolio

*Investors should note that asset allocation and diversification do not assure profit or protect against loss in declining markets, and neither can guarantee that any objective or goal will be achieved. Alternative investments may be illiquid in nature, may be redeemed at more or less than the original amount invested, are subject to special risks, and are not suitable for all investors. There is no assurance that the investment objective will be attained.

DECUMULATION PROCESS PHASE

The approach investors take must change as they transition into retirement. In the decumulation stage, wealth management becomes more difficult with taxes, tax-advantaged wealth transfer, and estate planning. The decumulation phase is the process of withdrawing money from your retirement savings to support your living expenses during retirement. Managing spending and taxes comes to the forefront, often caused by required minimum distributions (RMDs) and taxable income streams. Depending on your needs, income strategies, inflation, hedging alternatives, and annuities may come into play during this stage.

WEALTH TRANSFER PHASE

The wealth transfer stage of wealth management is the process of transferring assets from one generation to the next. This can be done through a variety of methods, including gifts, trusts, and inheritances. Some of the benefits of wealth transfer include preserving family wealth, reducing estate taxes, and ensuring assets are used in a way that is consistent with your wishes. Wealth transfer can be complex and time-consuming, can lead to family conflict, and may not guarantee your wishes are met. When planning for a wealth transfer, it is essential to consider the following factors:

- The transfer of assets may have tax implications for both the original owner and the beneficiaries.

- The needs and goals of the beneficiaries should be considered when planning for wealth transfer.

- The original owner’s wishes should be respected when planning for a wealth transfer.

- Several risks should be considered.

If you are considering wealth transfer, working with a financial advisor to understand the risks and benefits and develop a plan that meets your specific needs and goals is important.

Gain the Confidence to Pursue Your

Get a head start on your goals with a free tax strategy guide

Get It Now