PREPARING FOR RETIREMENT APPLYING WEALTH MANAGEMENT STRATEGIES

Retirement planning involves evaluating your current financial standing and creating an accumulation strategy that will help ensure a desired retirement lifestyle. A successful plan put into place during the wealth-building lifespan should address ways to maximize growth and tax-efficient distributions as well as ways to leave retirement assets to the next generation. By engaging in retirement planning early on, it can help you with:

- Making the most of your employer-sponsored plan and 401(k)

- IRA contributions and conversions

- Pensions and annuities

- Preparing for the behavioral and emotional aspects

- Self-employment retirement plans

- Social Security timing strategies

- Required minimum distributions, withdrawal strategies, and SEPPs

Key Retirement Areas of Focus

Retirement is more than simply having enough money. The other dynamic we help clients prepare for involves the behavioral and emotional aspects of transitioning into a fulfilling retirement.

Financing Retirement

There are several ways to save for retirement including qualified employer-sponsored plans and 401(k)s, individual retirement accounts (IRAs), annuities and pensions, personal savings, and executive deferral plans. Business owners or executives may also have access to other tax-advantaged retirement savings vehicles.

Social Security Timing

Retirees can apply for social security anytime between ages 62 and 70. Claiming as early as age 62, however, can permanently reduce not only your benefits but your spouse’s survivor benefits as well. While there is no magic age at which to claim social security, we created the Social Security Timing Strategies guide to walk you through the various options.

Withdrawal Strategies and Retirement Income Stream

Withdrawal strategies are paramount to any successful retirement plan and the distribution of accumulated assets is at the heart. The correct distribution method will help ensure that your retirement savings last beyond your lifetime, with minimum shrinkage from taxes. When it comes time to take required minimum distributions (RMDs), it may appear to be a simple matter of selling a particular stock. Except, there is something of an art to taking RMDs. Determining which assets to liquidate and when to do so requires careful analysis of projected returns, income streams, and taxable consequences. That’s why it is important to formulate a “safety first” withdrawal strategy to analyze the full range of sources available to you, including social security and employer plans.

Six Key Retirement Areas of Focus

Retirement is more than simply having enough money. The other dynamic we help clients prepare for involves the behavioral and emotional aspects of transitioning into a fulfilling retirement. To do this, we developed a guide on preparing for retirement which walks you through the six key aspects of retirement, some of which you may not have considered, including activities, wellness, relationships, interactions, personal development, and finances.

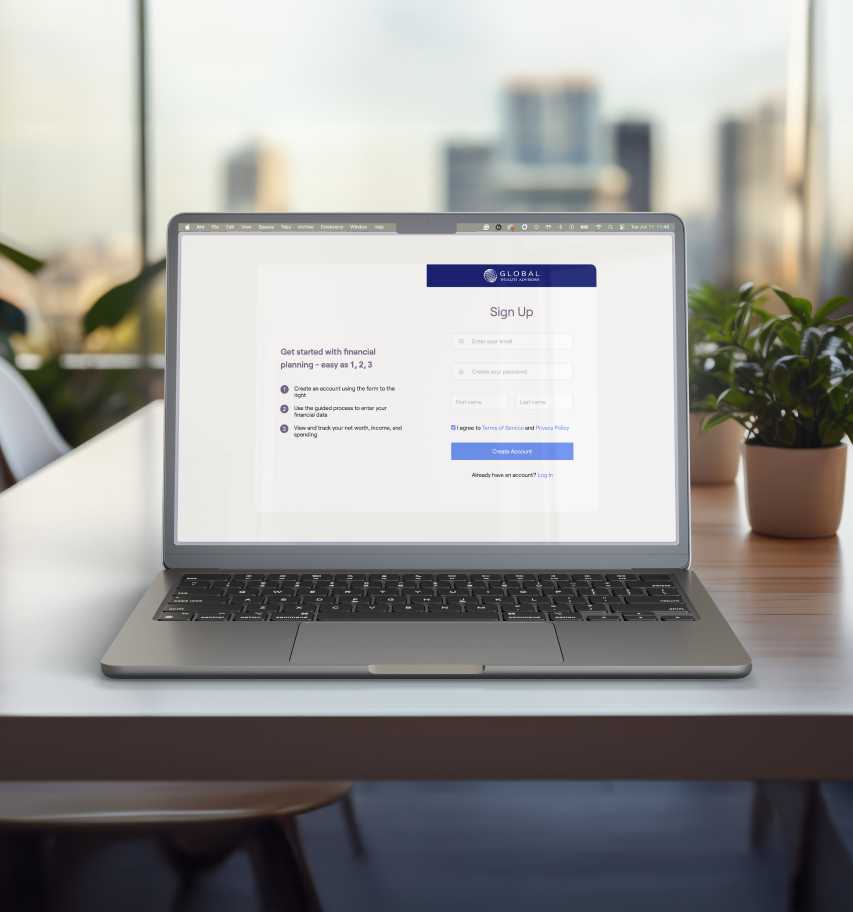

RETIREMENT

PLANNING APP

Generally, you can anticipate a third of your life to be left when you retire. This means that your preparations must be flexible enough to cover a large span of years. It can be tricky to come up with a plan that meets all of your retirement goals. By signing up for a free planning account, you can get the industry’s first integrated financial and tax planning app solution to help you identify, plan for, and track your goals. The app can help you:

-

- Optimize your tax strategies

- View your asset allocation

- See options to view your probability of success

- Receive notifications regarding upcoming tasks

- And much more!

Your retirement years can span decades and with any financial planning, you’ll want to seek professional advice to help ensure you remain on track and that your money lasts as long as you need it.