Required Minimum Distributions Mistakes

Your required minimum distribution (RMD) is the minimum amount you must withdraw from your retirement accounts each year once you reach a certain age. As we get older, however, many investors fail to think about the RMDs. This oversight can lead to unnecessary tax burdens and other financial issues.

Presented by: Kris Maksimovich, AIF®, CRPC®, CPFA®, CRC®

In order to handle RMDs effectively, an understanding of the rules and common misconceptions can be beneficial.

About Required Minimum Distributions

The terms of your retirement plan govern though generally, distributions begin at specific ages, even if you are still employed (if your plan allows this):

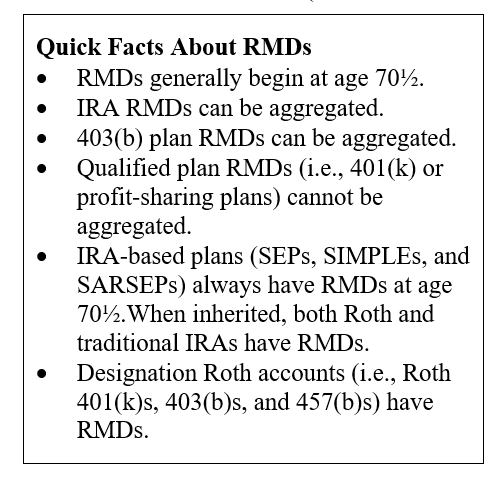

- IRA RMD Requirements (including SEPs and SIMPLE IRAs). April 1 of the year following the calendar year in which you reach age 72 .

- 401(k), profit-sharing, 403(b), or other defined contribution plan. April 1 following the later of the calendar year in which you reach age 72.

For the first year following the year you reach age 72, there are two required distribution dates. This includes an April 1 withdrawal for the year you turn 72 and an additional withdrawal by December 31. To include the income in separate tax years, you can make your first withdrawal by December 31 of the year you turn 72 instead of waiting until April 1 of the following year. For each year after, you must withdraw your RMD by December 31.

If you don’t take any distributions, or if the distributions aren’t large enough, you may end up paying a 50% excise tax on the amount not distributed as required.

You can withdraw more than the minimum required amount. Your withdrawals are also included in your taxable income, except for any part that was taxed before, or that can be received tax-free such as qualified distributions from designated Roth accounts. Roth IRAs do not require withdrawals until after the death of the owner, however, beneficiaries of a Roth IRA are subject to RMD rules.

Accounts Requiring RMDs

The minimum distribution rules affect the following types of accounts:

- Traditional IRAs

- 401(k) plans

- 403(b) plans

- 457(b) plans

- Profit sharing plans

- SEP IRAs

- SIMPLE IRAs

- Roth IRA beneficiaries

- Other defined contribution plans

Calculating Your Distribution

Your required minimum distribution for any year is the account balance as of the end of the calendar year immediately preceding, divided by a distribution period from the IRS’s Uniform Lifetime Table. Depending upon other types of circumstances, there may be other tables used so check with your tax advisor.

In the year you pass, the RMD due is the amount you would have been required to withdraw but did not withdraw, if any. Beginning the year following your death, the RMD is dependent on certain characteristics of the designated beneficiary.

7 Common RMD Mistakes

To avoid common errors surrounding RMDs, we discuss several misconceptions below. From oversight to how it can lead to issues at tax time, learn what the rules say and helpful tips.

Misconception 1: I took a Required Minimum Distribution from my 401(k). This will satisfy both the RMD for that account and the one I have to take for my IRA and any other account.

What the rules say: RMDs can be aggregated for certain accounts. For instance, if you have two traditional IRAs and each has an RMD of $1,000, you can withdraw $2,000 from one account to satisfy both RMDs. RMDs for SEP and SIMPLE IRAs can be aggregated with traditional IRAs as well.

This same RMD aggregation rule can be applied to multiple 403(b) plans. You cannot, however, take an RMD from a 403(b) plan to satisfy an RMD from an IRA. And when it comes to 401(k)s and other non-IRA accounts, such as profit-sharing plans, you must take a separate RMD from each plan.

Misconception 2: My mother passed away and left me her IRA. She hadn’t yet taken an RMD for the year. I don’t need to take one either.

What the rules say: When you inherit a traditional IRA from which the decedent (i.e., original account owner) was taking a Required Minimum Distribution, it is up to you as the beneficiary to satisfy any missed distribution and to pay the taxes on that distribution at your marginal tax rate. If there are multiple beneficiaries, the RMD amount is typically divided among the group, and each person is responsible for paying taxes on his or her portion from his or her own IRA beneficiary distribution account (BDA).

Tip: When multiple siblings are involved, one beneficiary may want to take a lump-sum distribution of the inherited account, rather than continue taking RMDs from an IRA BDA. In this case, the sibling taking the lump sum could use some of those funds to satisfy the decedent’s missed RMD, leaving the other siblings’ IRA BDAs intact until they reach their required beginning date and have to start taking their personal RMDs. Of course, this would require the sibling taking the lump-sum distribution to agree to the solution.

Misconception 3: I inherited an IRA BDA from a relative. I can base the RMDs on my own life expectancy factor.

What the rules say: Generally, RMDs from an inherited retirement vehicle are based on the beneficiary’s life expectancy. That isn’t the case when the account was previously inherited by another person—in that situation, the RMDs continue to be based on the previous beneficiary’s life expectancy. So, if A dies and leaves an IRA to B, B now has an IRA BDA. When B dies and leaves the IRA BDA to C, C must withdraw RMDs as if B, the original beneficiary, were still alive.

Misconception 4: I inherited a Roth IRA. I know my own Roth does not have RMDs. The same rule must apply to this inherited account.

What the rules say: Even though the account is a Roth IRA, because it is an inherited IRA—and, thus, a BDA—it is subject to IRA BDA rules, which means that RMDs must be taken.

Misconception 5: I just retired and have a substantial RMD due from my 401(k) plan and a small RMD due from my traditional IRA. I can just roll the 401(k) into the IRA and take the smaller RMD.

What the rules say: Although you can roll your 401(k) into a traditional IRA, the RMD amount is not eligible for rollover and must be taken from the 401(k) prior to the rollover. If, for some reason, the financial institution allows the RMD to be rolled with the other eligible assets, action must be taken to remove the RMD amount from the receiving IRA. Technically, the RMD amount attributed to the 401(k) was satisfied when the rollover occurred and now represents an ineligible excess contribution in the IRA. The RMD amount for the 401(k) must be removed as a return of excess contribution from the IRA (not a normal distribution) and returned to you.

Tip: The rules state that the required beginning date (RBD) for RMDs from a noninherited IRA is April 1 of the year following the year in which the account owner turns age 70½ or retires, whichever is later. The account owner in the above example, who retired in 2018, would have until April 1, 2019, to take RMDs from both accounts. The amounts of the RMDs would be based on the year-end 2017 value of each account.

Misconception 6: I am still working, so I don’t have to take an RMD from my SEP or SIMPLE IRA at my current employer.

What the rules say about 401k minimum distribution: Although you do not have to take an RMD from a 401(k) plan if you are still working, this exception does not exist for SEP or SIMPLE IRAs. Once you reach age 70½, regardless of employment status, RMDs need to come out of SEP and SIMPLE plans.

Ironically, if you are still working and active in the SEP or SIMPLE plan, you can continue to make contributions, even though you are also taking RMDs.

Misconception 7: I have a Roth 401(k) or 403(b), and just like my Roth IRA, I don’t need to take RMDs.

What the rules say: One of the more puzzling rules regarding RMDs is the fact that Roth 401(k) and Roth 403(b) plans both have RMDs. This is after-tax money, so the RMD does not increase your tax burden like a distribution from a traditional IRA would, but it can be a nuisance because, if you miss taking it, you will incur a 50-percent penalty. It may be smart to roll over these designated Roth accounts into a Roth IRA prior to the date you must start taking RMDs. Be aware, however, that if an RMD is due, that portion of the account balance is ineligible for rollover.

Check out our carefully curated articles on retirement planning strategy and RMDs.

Kris Maksimovich is a financial advisor located at Global Wealth Advisors 4400 State Hwy 121, Ste. 200, Lewisville, TX 75056. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. Financial planning services offered through Global Wealth Advisors are separate and unrelated to Commonwealth. He can be reached at (972) 930-1238 or at info@gwadvisors.net.

© 2025 Commonwealth Financial Network®

Latest News

How much does college really cost?

April 2, 2025

How Much Does Your Bracket Pick Really Cost? We hope you're just as excited as we were for this year’s March Madness Tournament and finally getting down to F...

READ MORE...Big News for Retirees: Social Security Fairness Act Repeals WEP and GPO

March 27, 2025

If you or your spouse have worked in both the public and private sectors—or if you’re currently drawing a government pension—there’s important news that...

READ MORE...Managing Taxes on Your Investments

February 19, 2025

Presented by Scott Portlock CFP®, CLU® When it comes to your money, it’s not what you earn, it’s what you keep. Here are some ideas that may help le...

READ MORE...Loading...