Timing an Indirect Rollover

When you leave a job, you have several options for dealing with the funds in your 401(k) or other employer-sponsored qualified plan.

Presented by: Kris Maksimovich, AIF®, CRPC®, CPFA®, CRC®

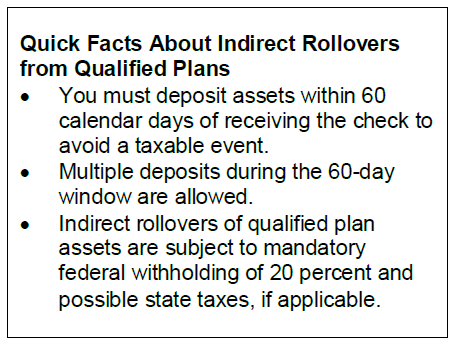

One option is an indirect rollover. With this method, you receive a distribution check from your employer and then have 60 days to deposit the funds into an IRA or your new employer’s plan.

What you need to know

While taking a distribution from your qualified retirement plan may seem attractive, it’s important to understand the drawbacks of indirect rollovers.

Mandatory withholding. Rollover-eligible distributions from qualified plans are subject to mandatory federal withholding of 20 percent. In other words, if you have $200,000 in your 401(k), your employer will withhold $40,000 and send you a check for $160,000. To avoid tax penalties, you have 60 days to deposit the $160,000, plus $40,000 from your savings to make up for the amount withheld, into an IRA or your new employer’s plan. You can’t recapture the amount withheld until you file your taxes for the year. Assuming you have no other tax liabilities to which it could be applied, the full amount withheld will be refunded. Please note: Depending on individual state requirements, state tax may also be withheld from the distribution.

60-day deadline. The 60-day rule for depositing the funds into an IRA or another qualified plan is hard and fast; there are no exceptions for weekends or holidays. If the 60th calendar day following the distribution falls on a Monday that happens to be a federal holiday and financial institutions are closed, the money would need to be rolled into the new account by the Friday prior or earlier. If you fail to meet the deadline, the distribution will be subject to taxes and possibly early withdrawal penalties.

You can apply for an extension of the 60-day time frame or request a waiver if you inadvertently miss the deadline via a private letter ruling (PLR). It’s best to consult with a legal or tax expert about your situation, as there is a fee to request a PLR, and the IRS uses a number of criteria to determine eligibility for a waiver or extension.

How it works

Let’s look at a real-life scenario to illustrate how an indirect rollover should (and shouldn’t) be carried out.

A successful indirect rollover: Sam, a 40-year-old employee, decides to leave his company, where he has a 401(k) plan worth $100,000. Ultimately, Sam wants to place the full amount in a traditional IRA with XYZ Investments, but he’s in the process of adding on to his home and thinks he may need some extra cash to complete the construction. He chooses to do an indirect rollover and requests a distribution check; after $20,000 is taken out for withholding, Sam receives $80,000.

As Sam finishes his home renovations, he realizes that he doesn’t need the extra money after all. So he takes the $80,000 he received, adds an additional $20,000 from his other assets to make up for the withholding, and deposits $100,000 into his IRA at XYZ Investments prior to the 60-day deadline. Because the amount distributed and the amount rolled into the IRA match ($100,000 went out of a 401(k), and $100,000 went into an IRA), Sam avoids a taxable event. If, however, he had deposited only $80,000 into the IRA, the $20,000 difference would be considered a taxable distribution.

A not-so-successful indirect rollover: Assume the backstory is the same as in the first example: Sam chooses to do an indirect rollover, 20 percent of the assets are withheld, and he receives an $80,000 distribution check. This time, though, Sam cashes the check and uses $40,000 to pay for the addition to his home. The 60-day deadline starts to worry him, so he decides to put a portion of the money into his traditional IRA, beginning with a sum of $20,000 and making more deposits every week thereafter.

In the end, he deposits $80,000 into his IRA prior to the 60-day deadline and puts a check for the remaining $20,000 in the mail via express delivery. It arrives at XYZ Investments over the weekend prior to the 60th day, which is a Monday and a federal holiday. As a result, the money can’t be deposited until after the deadline, even though the check arrived before the holiday.

The fact that Sam made multiple deposits in the 60-day window doesn’t affect the rollover, but missing the deadline for the last $20,000 is an issue. The amount is now considered a fully taxable distribution. Plus, as Sam is younger than 59½, it’s also subject to a 10-percent early withdrawal penalty.

The $20,000 that was already withheld may offset some, if not all, of the taxes and penalties, but Sam has another, more immediate problem. Because the $20,000 he sent to XYZ Investments is no longer eligible to be rolled over, it’s considered an excess contribution for that year. Sam will have to remove the excess contribution, including earnings, by the tax filing deadline or face a 6-percent excise tax on the $20,000.

With indirect rollovers, it pays to be cautious

Without careful planning, an indirect rollover can easily derail, exposing you to serious tax consequences. If you’re considering this course of action, it’s always wise to consult with a financial advisor before requesting a distribution check from your employer.

Learn more if you’re interested in consolidating your retirement accounts.

Commonwealth Financial Network® does not provide tax or legal advice. Please contact your tax or legal professional regarding your individual situation. If you are considering rolling over money from an employer-sponsored plan, such as a 401(k) or 403(b), you may have the option of leaving the money in the current employer-sponsored plan or moving it into a new employer-sponsored plan. Benefits of leaving money in an employer-sponsored plan may include access to lower-cost institutional class shares; access to investment planning tools and other educational materials; the potential for penalty-free withdrawals starting at age 55; broader protection from creditors and legal judgments; and the ability to postpone required minimum distributions beyond age 72, under certain circumstances. This list of considerations is not exhaustive. Your decision whether or not to roll over your assets from an employer-sponsored plan into an IRA should be discussed with your financial advisor and your tax professional.

Kris Maksimovich is a financial advisor located at Global Wealth Advisors 4400 State Hwy 121, Ste. 200, Lewisville, TX 75056. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. Financial planning services offered through Global Wealth Advisors are separate and unrelated to Commonwealth. He can be reached at (972) 930-1238 or at info@gwadvisors.net.

© 2025 Commonwealth Financial Network®

Latest News

How much does college really cost?

April 2, 2025

How Much Does Your Bracket Pick Really Cost? We hope you're just as excited as we were for this year’s March Madness Tournament and finally getting down to F...

READ MORE...Big News for Retirees: Social Security Fairness Act Repeals WEP and GPO

March 27, 2025

If you or your spouse have worked in both the public and private sectors—or if you’re currently drawing a government pension—there’s important news that...

READ MORE...Managing Taxes on Your Investments

February 19, 2025

Presented by Scott Portlock CFP®, CLU® When it comes to your money, it’s not what you earn, it’s what you keep. Here are some ideas that may help le...

READ MORE...Loading...