How Do Financial Advisors Make Money?

Many people wonder exactly how financial advisors make money. We look at the various ways your advisor might be compensated and what you get for the cost.

Presented by: Kris Maksimovich, AIF®, CRPC®, CPFA®, CRC®

In today’s client / financial advisor relationship, fee transparency is critical for both parties. Clients expect an advisor to be open and honest about what they charge and what that fee does and does not cover, so they can assign value to the service provided. Advisors should also want the client to understand fees. After all, the key to any long-term relationship is for both parties to feel like they are receiving value.

Value is the key word here.

When you go to a store but can’t find a price tag on an item, do you go up to the checkout line, swipe your card without knowing the dollar amount, and walk away with the item? Of course not. You probably look for a price scanner or ask an associate. Why? For a transaction to occur, the consumer must understand what they are giving up (cost) and what they are receiving (benefit), to determine if the benefit outweighs the cost in their mind (value) and if the purchase is warranted.

Financial advice is not a product at a grocery store but a service that is provided in exchange for a fee. The better financial advisors can explain the fee and what it covers, the more easily the client can decide if this is worth it.

With that in mind, today’s blog covers how financial advisors typically make money so you can ask your financial advisor better questions.

How do financial advisors make money?

Financial advisors generally make money in 3 ways:

- Asset management fee

- Fee for financial planning

- Commission

Asset Management Fee

The most common fee now seen in this industry is the asset management fee. Typically, this fee is charged as a percentage of the total amount of assets the advisor is managing.

For example, in 2021, according to Advisory HQ News Corp, the average annual asset management fee for an account size of $1 million was 1.02%. This means a fee of $10,200 / year.

Many firms charge Asset Management (or AUM) fees on a sliding scale based on the dollar amounts invested. This provides some incentive for clients to consolidate their investments to take advantage of lower AUM fees. It is common to see a fee ranging from 1% to 2% (or higher) on accounts under $1 million. Each firm is different, but be careful with “price shopping” when deciding on an advisor. If an advisor has higher fees, it could be for good reason. Perhaps they have been doing it longer, have more experience, more qualifications, or specialize specifically in your field – those things should be worth more to you.

Financial Planning Fee

The second type of fee we see is a fee for financial planning services.

Some advisors might include this as part of their Asset Management Fee discussed above, and some might separate it.

Keep in mind, that financial planning is different from asset management and requires a different skill set. While asset management is critical to reaching your financial goals, it is just one part of the overall financial planning process.

Effective asset management is a complicated process and involves many things. At a minimum, it requires a deep understanding of your client’s unique risk tolerance, investment time horizon, financial goals, and how to build a portfolio that provides the best chance of success with these considerations.

Financial planning is more “big picture” than investment management.

Thorough financial planning involves gaining a deep knowledge of the client’s life; their whole financial picture, spending habits, lifestyle, debt obligations, financial goals, life passions, and dreams are all part of this. The financial planning process then integrates every aspect of their financial picture into a comprehensive document that helps guide a client’s future financial decisions.

The added depth an advisor goes into to build a financial plan is why they often charge a separate fee for financial planning. It can be far more involved and provide a much bigger value to a client when it is integrated with investment management. The financial plan is one of the most critical aspects of finding success as an investor, and because of this, one can expect to pay a separate fee for it.

Commission

A third common way financial advisors earn compensation is through selling commission products. Though commission-based products are becoming less popular, they are still common and are not nearly as frowned upon as they once were.

Financial advisors received a bad rap over the years, and it comes down to the greed of a few bad apples. Driven by the motivation that if a client purchases a product, the advisor makes more money, some advisors in the past took advantage of clients and recommended products not necessarily in their best interest because the advisor received a bigger paycheck. This type of shady business practice caused many to lose trust in the industry as a whole – and rightfully so.

A Fiduciary Standard

The industry, however, has changed considerably since then. The DOL updated its language in 2018. Now, all advisors who register with the SEC are held to a fiduciary standard, meaning they are legally responsible for doing what is best for the client at all times. Advisors who register with FINRA have a suitability standard, similar to the fiduciary standard, in that advisors cannot simply recommend a product to a client without believing it is in the client’s best interest. The new law also requires advisors to disclose any potential conflict of interest. It states that all fees and commissions for retirement plans and retirement planning advice must be clearly disclosed in dollar form to clients.

The new laws surrounding the financial advisory industry fall short of removing commission-based investment products, and fee-based advisors would argue that’s not a bad thing. Most industry professionals would say that commission-based products were never the problem, to begin with, as there are in-fact times when commission-based products are a suitable option for the client.

Other ways financial advisors make money

Salary – An advisor could earn a regular paycheck, a set dollar amount from the company they work for.

Retainer Fee – Some advisors implement a retainer fee service model (similar to a lawyer). Clients pay an upfront fee, and that would buy you a certain amount of the advisor’s time which you can cash in on as needed.

Is Your Advisor Commission-Based, Fee-Based, or Fee-Only?

A question you can ask your advisor is if their business model is commission-only, fee-based, or fee-only. In our observation, the industry is trending towards fee-only or fee-based, with a handful of advisors still commission-based.

Commission-Based

Commission-based advisors earn most of their money by selling their clients products that have a commission. Most insurance products and some mutual funds offer commissions to advisors who sell their products.

The commission-based model is one that the industry as a whole seems to be shifting away from, although some still implement it.

Fee-Based

As mentioned above, fee-based is the business model for many independent advisors. It allows advisors to choose when it is appropriate to offer a commission product vs. a non-commission product. While some say this puts the advisor in a position where there is a conflict of interest, fee-based advisors will say this option provides them with the most flexibility to offer products that best suit the client. And with the new legal requirements, this is not a concern to many as it once was.

Fee-Only

Fee-only advisors do not sell commission-based products. This means they charge a fee for their advice and are unable to sell commission-based products. Many clients appreciate this model for the extra measure of simplicity and transparency, while some clients desire their advisors to have more flexibility in their offerings.

Now that we know how advisors are compensated, let’s look at how you, the client, pay these fees.

Are Financial Advisors worth their fees?

This is a separate topic, and much has been written on the cost benefits of financial advisors. Chances are, if you are reading this article, you are exploring the idea of hiring a financial advisor to help you either manage your assets or help you on your financial journey.

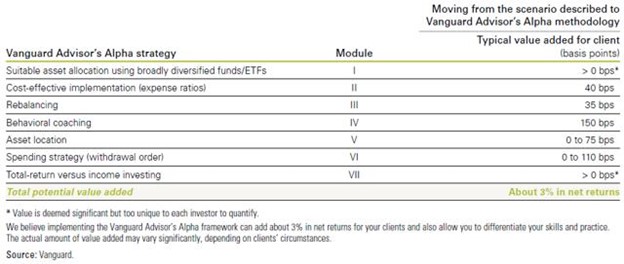

At this point, you might be wondering if an advisor can help an investor make more money than what they are spending in fees to the advisor. To answer this, we can look to a study by Vanguard that breaks down an advisor’s value into several categories, and the average amount of value an advisor brings to the client relationship. Take a look at the following chart:

Vanguard quantifies the value-add of best practices in wealth management

Figure 1: Vanguard quantifies the value-add of financial strategies.

This study concludes that the total potential net value added by a competent financial advisor is 3%. This is the net percentage, which factors in the average fee charged by an advisor. It is important to note that this is the average value provided, though consider several factors. For you to reach this number, we recommend looking for a competent advisor whose designations reveal a deep commitment to their practice. Designations include AIF®, CRPC®, and CFP®, which seek to deeply understand your unique financial situation, have a fiduciary standard to provide services in your best interest, and whose fees are fair.

You can find more about this study here: Putting a Value on Your Value Quantifying Advisor’s Alpha

We hope you’ve found this helpful as we expand on how financial advisors make their money. Hopefully, this transparency helps you ask better questions of your advisor, and find the best fit for you as you look for a professional to help guide you toward financial prosperity.

If you’re ready to get started let us know how we can help.

Sources: Putting a Value on Your Value Quantifying Advisor’s Alpha

Authored by Summit Wealth Group

Kris Maksimovich is a financial advisor located at Global Wealth Advisors 4400 State Hwy 121, Ste. 200, Lewisville, TX 75056. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. Financial planning services offered through Global Wealth Advisors are separate and unrelated to Commonwealth. He can be reached at (972) 930-1238 or at info@gwadvisors.net.

© 2024 Summit Wealth Group

Latest News

Big News for Retirees: Social Security Fairness Act Repeals WEP and GPO

March 27, 2025

If you or your spouse have worked in both the public and private sectors—or if you’re currently drawing a government pension—there’s important news that...

READ MORE...Managing Taxes on Your Investments

February 19, 2025

Presented by Scott Portlock CFP®, CLU® When it comes to your money, it’s not what you earn, it’s what you keep. Here are some ideas that may help le...

READ MORE...Protecting Yourself from Identity Theft

February 13, 2025

Presented by: Ben Murphy, CPA, PFS™, CPFA® You may be like most people. You believe that identity theft could never happen to you. Then, one day, y...

READ MORE...Loading...