WHY PAY FEES IF YOU CAN DO IT YOURSELF?

Except, there are cost benefits to using a professional financial advisor that go beyond merely increasing wealth and improving financial gain. There are additional important strategies to consider, like managing your risk tolerance and perception, improving your happiness, staying on track with the timeliness of activities, and managing your natural tendency to take action in a volatile market.

What’s more, it can be difficult to remain motivated and stay on track because your life is busy. Often, the activities associated with financial planning quickly fall off your radar. All of these factors can make using a professional financial planner worthwhile.

A WORD ABOUT FEES

When we meet with prospective clients, the elephant in the room is usually the fees. Nobody wants to give up their hard-earned money, so it is up to us to show you the value we bring. While many aspects are more tangible than others, some financial impacts are much harder to visualize or measure.

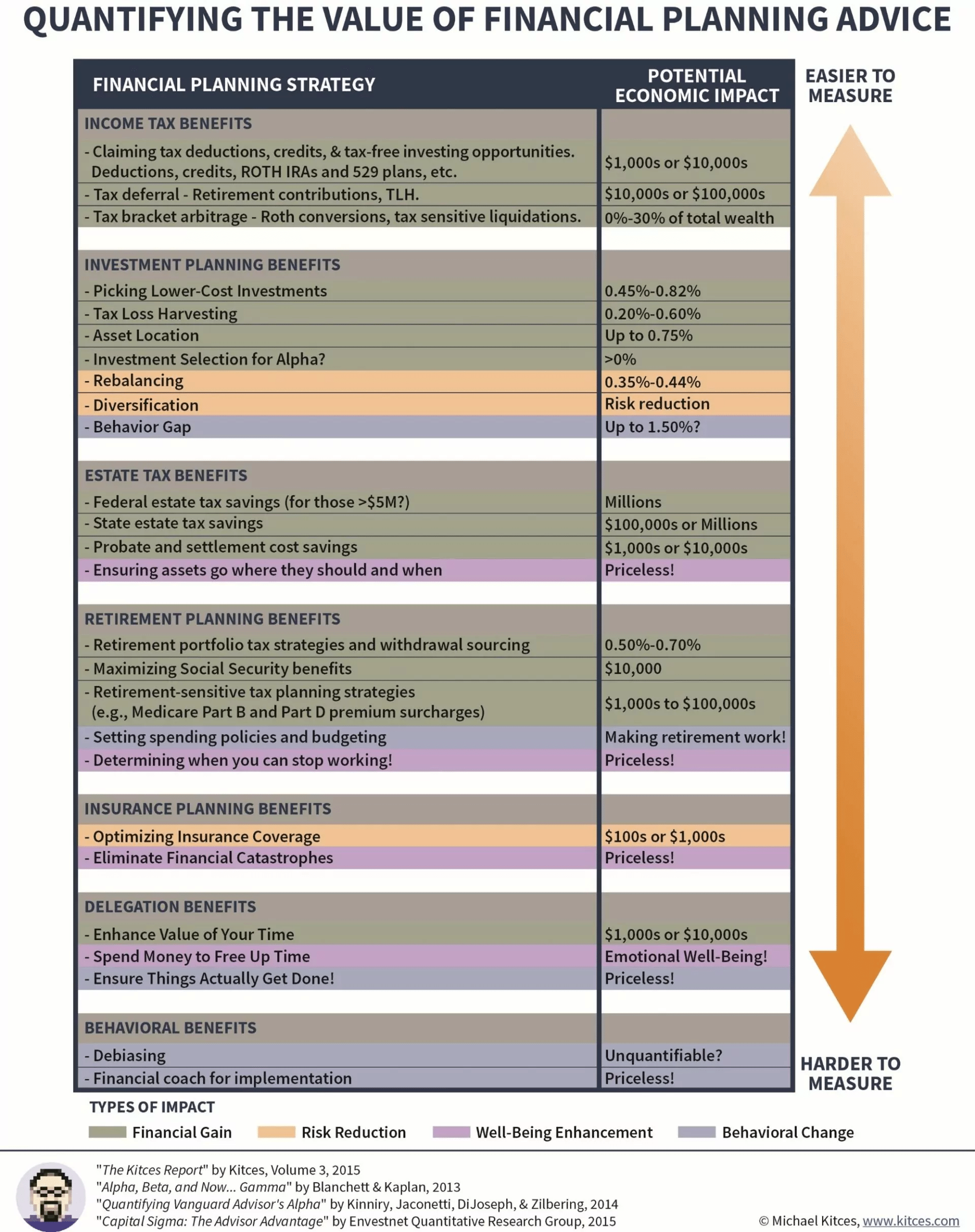

In 2015, Michael Kitces endeavored to quantify these values in the Kitces Report, Vol. 3, including data from Vanguard, Morningstar, and others. The Kitces report analyzes the potential quantifiable benefits you may gain that go far beyond any fees charged when you work with a financial advisor. A few additional benefits* include:

- Financial Gain

- Risk Reduction

- Well-Being Enhancement

- Behavioral Change

*Results may vary and cannot be guaranteed.

POTENTIAL ECONOMIC IMPACTS OF FINANCIAL PLANNING STRATEGIES

To help you visualize the benefits, this chart aims to quantify financial planning strategies and their potential impact. The items listed near the top of the chart are easier to quantify while moving down the chart, they become more difficult to measure. While all of the strategies listed below are an important part of financial planning, of note are the delegation benefits, various optimizations, well-being enhancements, and behavioral benefits*

Chart reprinted with permission. Click here to view or download a PDF copy.

*Results may vary and cannot be guaranteed.