Should You Cut the Cable Cord?

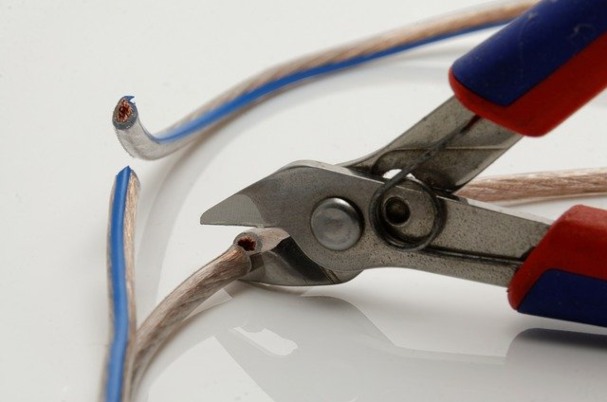

Think your cable bill is getting out of hand? The cost of cable has skyrocketed over the last decade. Find out what you can do to slash it.

Presented by: Kevin M. Curley, II, CFP®

If you think your cable bill is getting out of hand, you’re not alone. The cost of cable has skyrocketed over the last decade, with the average monthly bill in 2023 climbing to around $200 for basic and premium channels, according to Cord Cutter’s News.

Cable TV has become so ingrained in our culture that it might be difficult to imagine life without it. But the tides are turning in the entertainment industry, as the Internet ushers in a host of new viewing options. Could cable really be on its way out? According to a study by Nielsen, the number of “zero TV” households—those that don’t subscribe to cable TV—increased from 2 million in 2007 to more than 5 million in 2013.

Think you’re ready to pull the plug on cable? Below are some factors to consider.

What could you save?

Many families could use an extra $200 per month, and the savings are even more dramatic if you calculate the cost of cable over a lifetime. What if, starting at age 23, you instead placed this money in an investment portfolio, leaving it there until you reached age 80? Using AARP’s investment calculator, assuming a 6-percent rate of return and an inflation rate of 3 percent, you could potentially save nearly $735,900!*

Of course, the amount you’re able to put away will vary depending on your current cable package. If you have a bundle deal that includes phone, TV, and Internet, the fee for standalone Internet may be more than you expect, as bundled services typically come at a discount. Be sure to look into the actual costs of keeping your Internet and phone service, along with any cable alternatives you’re interested in.

Cable alternatives

Thanks to a growing array of web-based services, canceling your cable subscription no longer means missing out on your favorite programs. Here’s a look at some of the more popular options:

- Streaming video-on-demand. Streaming services such as Netflix, Hulu Plus, and Amazon Prime and many others offer a wide variety of TV shows and movies that you can access any time you choose. At about $10-20 per month, a subscription to one of these services is a steal compared with the $2,400 average yearly cable bill. To stream the content directly to your TV you’ll also need to purchase a Smart TV or device like a Firestick or Roku, or use a gaming system like Nintendo Wii or Sony Playstation. An even less expensive option is to connect your computer or smart device directly to your TV with a cable or cord. And for mobile viewing, these subscriptions include an app that you can download to your tablet or smartphone.

- Free online programming. Major TV networks like NBC, ABC, and FOX make full episodes of some programs available on their own websites, for free. You can also view a variety of TV shows and movies on Hulu, Peacock, and others without a subscription.

- Setting up your TV the old-fashioned way. No longer limited to “rabbit ears,” television antennas are making a comeback. Depending on where you live and the type of antenna you choose, you may be able to pick up a number of basic HD channels.

What you might miss

Of course, cable TV hasn’t been around this long by accident. Before you cut the cord, be sure you’re ready to part with the perks.

- A variety of channels. If you love flipping through channels to find interesting new shows, cable may be worth the cost. Plus, programs from some premium channels, like HBO and Showtime, aren’t always available through Netflix and other streaming services. (You need a regular HBO subscription to access shows through HBO Go, the network’s online service.)

- “First viewer advantage.” In the age of social media, it’s hard to avoid spoilers for TV shows and movies. Although some shows may be available for streaming immediately after they run on television, there may be a long wait for other series. If you’re impatient, then cable TV might still be your best bet.

- News broadcasts and live sports. Though news is available from many online sources, you may prefer to tune into your local broadcast. Perhaps the main reason that many people keep cable, however, is coverage of live sporting events. (Cable companies have figured this out and don’t offer ESPN in basic packages.) Unfortunately, the options for watching live sports online are often quite limited. For example, NBA League Pass offers a subscription for some live games. Those blacked-out are available three days later for local games and 3 hours for nationally broadcast games.

Still not sure?

With all the entertainment options out there, sorting through your choices can be time-consuming. Hulu’s cord-cutting calculator—can help you find a solution that fits your needs, as well as tell you how much you could save each month.

And if cutting cable seems like too big a step, here’s another idea: Simply call your cable provider and try to negotiate a better deal on your current package.

* This is a hypothetical example and is for illustrative purposes only. No specific investments were used in this example. Actual results will vary. Past performance does not guarantee future results.

Kevin M. Curley, II is a financial advisor located at Global Wealth Advisors 100 Crescent Court, 7th Floor, Dallas, TX 75201. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA / SIPC, a Registered Investment Adviser. Financial planning services offered through Global Wealth Advisors are separate and unrelated to Commonwealth. He can be reached at (214) 613-6580 or at info@gwadvisors.net.

© 2024 Commonwealth Financial Network®

Latest News

Digital Legacy Planning: Protecting Your Online Assets

December 9, 2024

Over the years, you’ve carefully managed your finances online—whether it’s checking your bank accounts, making investments, or paying bills. Your cloud st...

READ MORE...Navigating Joint or Separate Bank Accounts

November 7, 2024

You’ve booked the venue, picked out the flowers, and sent the invites. But have you talked about who’ll pay the electric bill after the wedding? Managing fi...

READ MORE...Should You Buy an Umbrella Insurance Policy?

October 30, 2024

High-net-worth individuals often have complex financial portfolios that include substantial assets, investments, and businesses. While they enjoy financial succ...

READ MORE...Loading...