Advisor vs. Adviser: What’s the Big Deal?

When it comes to the world of financial services and the difference between advisor vs adviser, one simple letter may make a difference.

Written by: Kris Maksimovich, AIF®, CRPC®, CPFA®, CRC®

What is the difference between advisor vs adviser?

Both titles have deep roots and have been used interchangeably for decades. Webster suggests that either “advisor” or “adviser” can be used as both spellings define an individual who engages in the act of advising or offering recommendations. While many in the financial services favor the “-or” version, the Associated Press Style Guide favors the “-er” version. The one distinction that most can agree upon is that both spellings are correct provided they are used consistently throughout a content piece.

If both advisor and adviser mean the same thing, then, what exactly is the big deal about the spelling within the financial services industry? The use of “advisor” or “adviser” is far from subjective as some articles on the subject might suggest. In fact, arguing the case for either spelling can send one down an unending dictionary rabbit hole. Either way, the favoritism of one title over another appears to be a source of confusion for investors.

Regulatory Roots

Whether the preferred title a financial professional uses is “advisor” or “adviser”, the choice of spelling appears to be steeped in history rather than vanity. Where once financial professionals labeled themselves as “advisers”, regulatory changes made in the 20th century brought about a mass migration of firms adopting the “advisor” label.

One shift that occurred is a result of the gross abuse of investment funds prior to the Act. Funds were often created by “advisers” who dominated the boards of directors for these funds. Rather than increase the value, they placed their own interests, and that of their associates, ahead of investors. During the Great Depression, it became obvious that a crackdown was necessary to end the investment advising abuse that was running rampant during this grave era. When the U.S. Investment Advisers Act of 1940 was passed, it inadvertently spelled out a difference by referring to the regulation of “advisers”.

Another shift appears to have occurred naturally as a result of the act. The Act requires “investment advisers” to register with a governing body, thus a professional might work for a Registered Investment Adviser (RIA), or they may be an Investment Adviser Representative of a firm (IAR). If a financial professional is engaged in providing ongoing investment advice for compensation, they are required to register as an investment “adviser” regardless of how they spell their title. The naming of governing bodies and the verbiage spelled out in the Act have come to characterize the widely accepted legal and regulatory “adviser” spelling adoption.

Applying this historical context, it is not surprising to see that the adviser spelling has been in print use much longer and may explain why it is the preferred spelling for many long-established dictionaries and journalist sources.

The Advisor vs. Adviser Switch

Outside of the regulatory language, there are other driving forces that may have helped instigate this shift in spelling. The advisor adaptation likely originated from the root word “advisory”. Professionals gradually adopted the more impressive “advisor” version as a means of distinguishing themselves from the more regulatory “adviser” governing body.

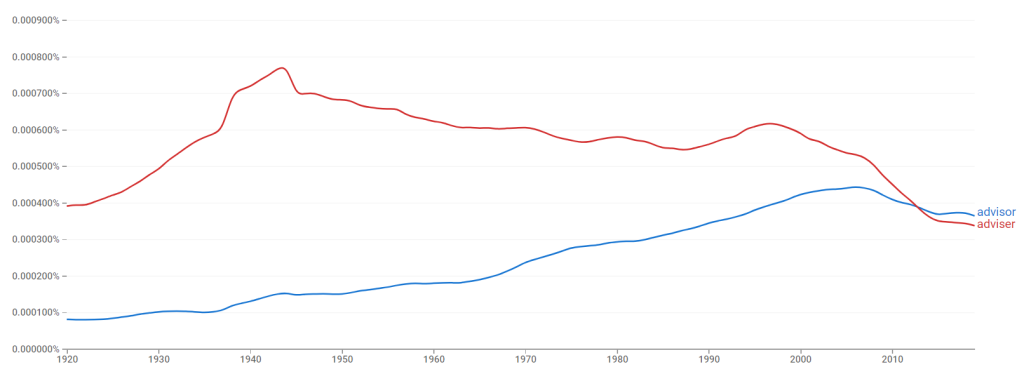

Over time there also appears to be a shift in public perception. An advisor is generally recognized synonymously as a professional. Though some professionals do still prefer the “-er” version, the numbers have dwindled since the 1940 Act. According to Google NGram Viewer, which is an indicator of the use of words in print, the use of advisor has overtaken the use of adviser since 2012.

Further Distance in Spelling

The Wall Street Crash of 1929 and the ensuing Great Depression lasting through 1939 were an impetus for change in the financial services industry. It’s not difficult to see why financial professionals might want to distance themselves from the rogue “advisers” and their unscrupulous activities prior to the 1940 Act. Since then, the switch from “adviser” to “advisor” has been widely adopted and it is now customary to use the “-er” spelling as related to a legal, governing body and the “-or” spelling as relating to practicing professionals.

Though the Securities and Exchange Commission (SEC) has not weighed in on any regulatory distinction between the spellings, they do focus on whether a professional conforms to laws designed to protect investors. Notably, a portion of this regulation involves avoiding misrepresentation. The reality is that while financial professionals have long been accused of rearranging the spelling to inflate their importance, that sentiment would not pass regulatory muster without the SEC establishing rules on such use.

When searching for a financial professional or wading through a stream of planning strategies, depending upon the site searched, it may net different results if seeking an “adviser” versus “advisor”. Regardless of which spelling financial professionals use, you should expect to receive the same professional services you are searching for. That is, after all, what is more important than a lesson in spelling?

Kris Maksimovich is a financial advisor located at Global Wealth Advisors 4400 State Hwy 121, Ste. 200, Lewisville, TX 75056. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. Financial planning services offered through Global Wealth Advisors are separate and unrelated to Commonwealth. He can be reached at (972) 930-1238 or at info@gwadvisors.net.

© 2024 Global Wealth Advisors®

Latest News

Digital Legacy Planning: Protecting Your Online Assets

December 9, 2024

Over the years, you’ve carefully managed your finances online—whether it’s checking your bank accounts, making investments, or paying bills. Your cloud st...

READ MORE...Navigating Joint or Separate Bank Accounts

November 7, 2024

You’ve booked the venue, picked out the flowers, and sent the invites. But have you talked about who’ll pay the electric bill after the wedding? Managing fi...

READ MORE...Should You Buy an Umbrella Insurance Policy?

October 30, 2024

High-net-worth individuals often have complex financial portfolios that include substantial assets, investments, and businesses. While they enjoy financial succ...

READ MORE...Loading...