Introduction to Asset Allocation

Considering asset allocation and rebalancing your portfolio? These examples may help ensure your investment plan meets your long‑term goals.

Presented by: Kris Maksimovich, AIF®, CRPC®, CPFA®, CRC®

Asset allocation is the process of dividing your investment dollars among a variety of complementary asset classes, such as stocks; bonds; real estate; and short‑term, highly liquid vehicles—including money market funds—so that your portfolio is well diversified.

What is asset allocation and how does it work?

The ultimate objective of an asset allocation program is to develop an investment portfolio that is properly aligned with your investment objectives and risk tolerance. A well‑diversified portfolio will rarely outperform the top asset class in any given year, but over time, it has often been one of the most effective ways to pursue long‑term financial goals. Key benefits of a sound asset allocation strategy include:

Reduced risk. A properly allocated portfolio strives to lower volatility, or fluctuation in return, by simultaneously spreading market risk across several asset class categories.

More consistent returns. By investing in a variety of asset classes, you can improve your chances of participating in market gains and lessen the impact of poorly performing asset class categories on overall results.

A greater focus on long‑term goals. A properly allocated portfolio is designed to alleviate the need to constantly adjust investment positions to chase market trends. It can also help reduce the urge to buy or sell in response to short‑term market swings.

Viewing Asset Allocation in Practice

Although there is a broad range of asset classes in which you can invest, most investment professionals agree that a strong allocation strategy includes stocks, bonds, real estate, and cash equivalent instruments.

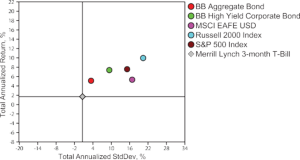

The chart below illustrates the performance of each of these core asset class categories for the 20‑year period ending December 31, 2020. During this time period, stocks outperformed bonds, and bonds outdistanced money markets. In turn, the volatility declined from stocks to money markets.

In any given 20‑year time period, one can expect the various asset classes to perform differently and to assume varied levels of volatility in relation to one another.

20‑Year Asset Class Performance – December 2000–December 2020

Source: MPI Analytics. Stocks: S&P 500 Index, Russell 2000 Index, and Morgan Stanley Capital International (MSCI), Europe, Australia, and Far East (EAFE) Index. Bonds: Bloomberg Barclays U.S. Aggregate Bond Index and Bloomberg Barclays U.S. Corporate High Yield Total Return Index. Commodities: Bloomberg Commodity Index. T‑Bills/Cash: Bank of America U.S. 3‑Month Treasury Bill Index. Results are for the 20‑year period ending in December 31, 2020, and assume full reinvestment of dividends and capital gains. Volatility is measured by standard deviation and shows how past returns vary from the average rate of return for the period considered. The higher the standard deviation, the higher the price volatility and fluctuation. The lower the standard deviation, the lower the level of investment risk. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results.

Source: MPI Analytics. Stocks: S&P 500 Index, Russell 2000 Index, and Morgan Stanley Capital International (MSCI), Europe, Australia, and Far East (EAFE) Index. Bonds: Bloomberg Barclays U.S. Aggregate Bond Index and Bloomberg Barclays U.S. Corporate High Yield Total Return Index. Commodities: Bloomberg Commodity Index. T‑Bills/Cash: Bank of America U.S. 3‑Month Treasury Bill Index. Results are for the 20‑year period ending in December 31, 2020, and assume full reinvestment of dividends and capital gains. Volatility is measured by standard deviation and shows how past returns vary from the average rate of return for the period considered. The higher the standard deviation, the higher the price volatility and fluctuation. The lower the standard deviation, the lower the level of investment risk. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results.

Proponents of asset allocation argue that rather than investing in a single asset class, investors should consider allocating a portion of their portfolios to several asset class categories in an effort to achieve higher risk‑adjusted returns over time. The theory behind this approach was developed in 1952 by economist Harry Markowitz, who discovered that overall portfolio risk can be reduced by combining various asset classes whose returns are not perfectly correlated or whose returns do not move in unison.

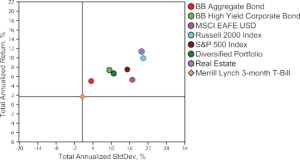

Modern Portfolio Theory

Markowitz’s Nobel Prize‑winning theory, Modern Portfolio Theory, is illustrated by the chart below. The diversified portfolio, which held 35 percent in stocks, 45 percent in bonds, 10 percent in real estate, and 10 percent in cash equivalent instruments, performed almost as well as the all‑stock portfolio. It captured 81 percent of the return of the all‑stock portfolio, with 46 percent less volatility—a trade‑off most investors would gladly accept and one that illustrates how effective asset allocation can be.

20‑Year Diversified Portfolio Returns – December 2000–December 2020

Source: MPI Analytics. Stocks: S&P 500 Index, Russell 2000 Index, and MSCI EAFE Index. Bonds: Bloomberg Barclays U.S. Aggregate Bond Index and Bloomberg Barclays U.S. Corporate High Yield Total Return Index. Commodities: Bloomberg Commodity Index. Real Estate: Dow Jones Select REIT Index. T‑Bills/Cash: Bank of America U.S. 3‑Month Treasury Bill Index. Results are for the 20‑year period ending in December 31, 2020, and assume full reinvestment of dividends and capital gains. Volatility is measured by standard deviation and shows how past returns vary from the average rate of return for the period considered. The higher the standard deviation, the higher the price volatility and fluctuation. The lower the standard deviation, the lower the level of investment risk. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results.

Source: MPI Analytics. Stocks: S&P 500 Index, Russell 2000 Index, and MSCI EAFE Index. Bonds: Bloomberg Barclays U.S. Aggregate Bond Index and Bloomberg Barclays U.S. Corporate High Yield Total Return Index. Commodities: Bloomberg Commodity Index. Real Estate: Dow Jones Select REIT Index. T‑Bills/Cash: Bank of America U.S. 3‑Month Treasury Bill Index. Results are for the 20‑year period ending in December 31, 2020, and assume full reinvestment of dividends and capital gains. Volatility is measured by standard deviation and shows how past returns vary from the average rate of return for the period considered. The higher the standard deviation, the higher the price volatility and fluctuation. The lower the standard deviation, the lower the level of investment risk. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results.

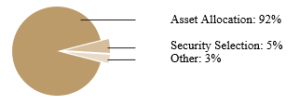

The Brinson, Singer and Beebower Study

Another study, published in 1991 by Gary Brinson, Brian Singer, and Gilbert Beebower, further cemented the value and benefits of asset allocation, concluding that the asset classes used, and the extent to which each is weighted in an investor’s portfolio, are the most important decisions an investor can make.

They determined that asset allocation decisions account for approximately 92 percent of a portfolio’s long‑term performance. Individual investment selection accounts for only 5 percent, while other factors—market timing included—account for a mere 3 percent of portfolio performance.

Factors of Portfolio Performance

Source: Gary P. Brinson, Brian D. Singer, and Gilbert L. Beebower. “Determinants of Portfolio Performance II: An Update,” Financial Analysts Journal, May–June 1991.

Source: Gary P. Brinson, Brian D. Singer, and Gilbert L. Beebower. “Determinants of Portfolio Performance II: An Update,” Financial Analysts Journal, May–June 1991.

This study supports the idea that in addition to the core asset categories—stocks, bonds, real estate, and cash equivalent instruments—investors should consider including sub‑asset class categories, particularly as their portfolios increase in value.

Within the equity arena, these subcategories might include multiple styles (value, blend, growth), company sizes (small‑, mid‑, and large‑cap), and geographic regions (foreign and domestic). In the fixed income arena, one might consider government bonds, corporate bonds, mortgages, and municipalities, with a conscious effort to include bonds of varying maturity and credit quality. Diversification at this level can further dampen volatility, as various subcategories often react differently to changing economic and market conditions.

The process of determining which asset classes to include and the appropriate weights to assign to each is, in part, defined by your time horizon, risk tolerance, and familiarity or comfort level with the financial markets and various investment products.

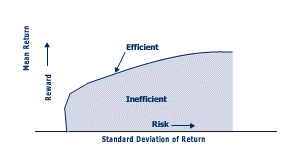

The Efficient Frontier

The outgrowth of Markowitz’s work on Modern Portfolio Theory was the development of a plotted graph identifying portfolios that have the maximum expected return for any given level of risk, or the minimum level of risk for an infinite number of asset class combinations.

By plotting each portfolio or combination of asset classes on one axis and the volatility measures—or standard deviations—on another, a line graph representing the optimal combination of asset classes for various levels of risk is produced. This graph is known as the “efficient frontier.”

Efficient Frontier

Source: Harry Markowitz, “Portfolio Selection,” Journal of Finance, 1952. Standard deviation is an indicator of a fund’s total return volatility. The larger the fund’s standard deviation, the greater its volatility.

Source: Harry Markowitz, “Portfolio Selection,” Journal of Finance, 1952. Standard deviation is an indicator of a fund’s total return volatility. The larger the fund’s standard deviation, the greater its volatility.

Points on or under the curve (in the darker area) represent the possible combinations of investments. Points above the curve (in the lighter area) are unobtainable combinations given the particular set of available asset class categories. The curve itself represents where you could not obtain higher average returns without generating higher volatility or where you could not obtain lower volatility without generating lower average returns.

The portfolios that lie directly on the curve are viewed as efficient, which is why the curve itself is called the efficient frontier. Portfolios that lie below the curve are deemed inefficient, as alternative portfolios exist with higher returns, lower volatility, or both. Utilizing efficient frontier analysis, advisors can select which asset classes to include in a given portfolio and then view all possible combinations of those asset classes to help determine the most appropriate mix for each client.

Until recently, the benefits of the revolutionary efforts of Markowitz and others in the financial arena have been largely reserved for institutional and high‑net‑worth investors who were able to access the high‑level mathematicians and computer systems needed to capture, calculate, and report risk and return data on a multitude of asset class categories. Now, with advances in computer technology and additional studies done to quantify the true value of the asset allocation decision, sophisticated software programs are available to help financial planners and investment advisors construct and manage client portfolios for investors at any level.

Things to Remember about Asset Allocation

Asset allocation is a critical element to any sound investment plan. By building a portfolio that encompasses a wide selection of securities and a broad range of asset classes and investment styles, you can help protect your portfolio from sudden changes in the financial markets. A diversified strategy can potentially help you attain your long‑term goals more readily and with additional financial confidence.

There can be no guarantee that any particular yield or return will be achieved from any investment. Investors should note that diversification does not assure against market loss and that there is no guarantee that a diversified portfolio will outperform a nondiversified portfolio.

A change in your goals, time horizon, risk tolerance, or personal financial situation may require a change in your strategic asset allocation, which is why it’s important to periodically review your asset allocation strategy. For example, as your time horizon shortens, you may have less time to recoup losses from sudden market downturns. Therefore, you might consider a more conservative asset mix. In contrast, investors whose financial situation has improved significantly or who have become more comfortable and experienced with more volatile assets, such as stocks, might shift to a more aggressive allocation strategy.

Fluctuations in the financial markets may also necessitate a reassessment of your portfolio. For example, if you begin an investment program with 75 percent of your money in stocks, 20 percent in bonds, and 5 percent in money market funds, several years of strong stock market performance (as was the case from 2009 through most of 2020) could quickly shift your allocations. The resulting, unplanned overexposure—or in negative conditions, underexposure—to an asset class may not be in keeping with your risk tolerance, investment goals, and time horizon.

That’s why it is important to maintain an ongoing dialogue with your financial professional to establish and periodically rebalance your portfolio, so you can help ensure that your investment plan remains consistent with your long‑term goals.

Check out these additional articles on asset protection.

Kris Maksimovich is a financial advisor located at Global Wealth Advisors 4400 State Hwy 121, Ste. 200, Lewisville, TX 75056. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. Financial planning services offered through Global Wealth Advisors are separate and unrelated to Commonwealth. He can be reached at (972) 930-1238 or at info@gwadvisors.net.

© 2025 Commonwealth Financial Network®

Latest News

How much does college really cost?

April 2, 2025

How Much Does Your Bracket Pick Really Cost? We hope you're just as excited as we were for this year’s March Madness Tournament and finally getting down to F...

READ MORE...Big News for Retirees: Social Security Fairness Act Repeals WEP and GPO

March 27, 2025

If you or your spouse have worked in both the public and private sectors—or if you’re currently drawing a government pension—there’s important news that...

READ MORE...Managing Taxes on Your Investments

February 19, 2025

Presented by Scott Portlock CFP®, CLU® When it comes to your money, it’s not what you earn, it’s what you keep. Here are some ideas that may help le...

READ MORE...Loading...