Are Subscriptions Draining Your Bank Account?

In a world full of monthly charges—from streaming platforms to meal kits and fitness apps—it’s easy to lose track of how much is really going toward subscription services. These seemingly minor charges can add up significantly over time, impacting your budget more than you might realize.

How To Identify, Track, and Manage Subscriptions

This month’s post “Are Subscriptions Draining Your Bank Account?” dives into the potential financial toll of subscriptions and offers practical tips on how to identify, track, and manage these recurring expenses.

As always, we’re here to help you make the best financial choices for yourself and your family. If you have questions about managing your subscriptions or would like to discuss strategies for optimizing your financial plan, please don’t hesitate to reach out to our office.

You open your bank statement and notice a string of small charges you barely remember signing up for—a streaming service you signed up for during the pandemic, the meditation app you downloaded during a stressful week, and a digital magazine subscription you haven’t read in months. When you added these on, each charge seemed minor. But over time, these subscriptions can add up, draining hundreds or even thousands of dollars from your account. That $50 a month? That’s $600 yearly—enough for a weekend getaway or a solid contribution to your emergency fund. But the good news? Reclaiming control over your subscriptions is simpler than you might think. Even your daily cable bill could renew at higher rates!

The Subscription Landscape

Today, our lives are filled with subscriptions. Besides the usual streaming services, companies now offer recurring payments for meal kits, pet supplies, beauty products, fitness programs, and even car features. While they all promise convenience, these ongoing charges can quickly add up and overwhelm your budget. Often, people don’t realize the true cost of all these services combined.

Find Hidden Costs

A great first step is to review your bank and credit card statements from the past three months. Look for any recurring charges, especially those tied to digital services and app stores, which can often hide under unfamiliar company names. Free trials that quietly transitioned into paid plans or annual subscriptions renewed without your notice are common.

To simplify this process, try using a dedicated credit card just for subscriptions. This keeps all charges in one place, making it easier to track your spending. You might also check whether your bank offers subscription-tracking tools, which are increasingly available through mobile apps.

The Auto-Renewal Trap

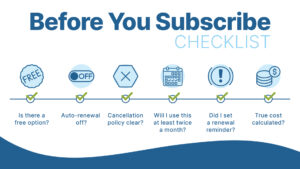

Auto-renewal settings often work against your financial interests. Many companies rely on customers forgetting about renewal dates or finding cancellation processes too complicated. Disable auto-renewals when possible, and set calendar reminders five to seven days before renewal dates. This gives you a chance to review whether the service is still valuable and check for any price increases or free alternatives.

Subscription rules are becoming more consumer-friendly, too. The Federal Trade Commission (FTC) recently finalized a “click to cancel” rule to make cancellations as easy as sign-ups. Under this rule, companies, including gyms, streaming platforms, and cable providers, will need to offer cancellation options as simple as the sign-up process. This rule, expected to take effect sometime in early 2025, will help prevent consumers from feeling “tricked or trapped into subscriptions.” While some companies argue it’s an undue burden on their processes, the rule’s goal is clear: to empower you to regain control of your subscriptions and stop paying for services you don’t need.

Watch for Hidden Requirements

Before purchasing a subscription, look into any required add-ons. That new fitness device may need a monthly app subscription to unlock basic features, or a tool you downloaded may be free only for the first month. To avoid unexpected fees, read the fine print, and consider these ongoing costs in your decision-making.

Find Free Alternatives

Many paid subscriptions have great free alternatives. Your local library often provides free access to digital books, magazines, movies, and even some streaming services. Try these ideas for cutting subscription costs:

- Use shared family plans for streaming services rather than separate accounts

- Check out YouTube for free workouts instead of relying on paid fitness apps

- Look into your library’s digital catalog before paying for entertainment subscriptions

Take Action on Subscriptions ASAP

Take 15 minutes tonight to start a subscription audit. Create a simple list or spreadsheet of each service, noting its monthly cost, renewal date, and how often you use it. Cancel any unnecessary subscriptions right away and remove your payment info to prevent future charges.

Next, calculate your total annual spending on subscriptions. This number is often surprising! Consider if that amount might be better directed to other financial goals, like building an emergency fund or saving for retirement. For services you keep, check for annual payment discounts, which can be more economical than monthly payments.

Build Better Habits

Here’s a helpful habit: wait 24 hours before signing up for any new subscription. This cooling-off period can help prevent impulse decisions. When you do subscribe to something new, set up a renewal reminder in your calendar so you’ll remember to review it.

Convenience is great—but not when it drains your finances. By managing your subscriptions proactively, you can enjoy services that add real value to your life while keeping more money in your wallet. The key is to stay aware of where your money goes and ensure that every recurring charge serves your financial goals.

© 2025 Commonwealth Financial Network®

© 2025 Commonwealth Financial Network®

Latest News

How much does college really cost?

April 2, 2025

How Much Does Your Bracket Pick Really Cost? We hope you're just as excited as we were for this year’s March Madness Tournament and finally getting down to F...

READ MORE...Big News for Retirees: Social Security Fairness Act Repeals WEP and GPO

March 27, 2025

If you or your spouse have worked in both the public and private sectors—or if you’re currently drawing a government pension—there’s important news that...

READ MORE...Managing Taxes on Your Investments

February 19, 2025

Presented by Scott Portlock CFP®, CLU® When it comes to your money, it’s not what you earn, it’s what you keep. Here are some ideas that may help le...

READ MORE...Loading...